And Will It Still Be Around For The Next Generation?

By Melvin J. Howard

If you look at your pay-stub you will see

two deductions for FICA taxes. Ever wondered what it means? Well FICA stands

for Federal Insurance Contributions Act and covers two basic benefits for

retirees and disabled persons:

Social Security:

Labeled as FICA-OASDI or

Old Age and Survivors Insurance and Disability Insurance. This provides pension

benefits to retirees, survivors and disabled persons.

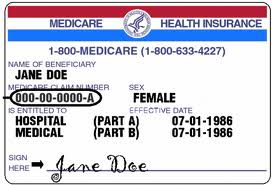

Medicare:

Labeled as FICA-HI or

Health Insurance. This provides medical insurance for retirees, survivors and

disabled persons.

Some of you may be aware

that the amount of money the government collects from employees and employers

as the FICA taxes has exceeded the government's obligations in Social Security

and Medicare payments for the past three decades. This has been true since FICA

taxes were increased under the Reagan administration in 1983, at a time when

other Federal Income Taxes were reduced. Then the question is "What has

the government done with that excess money?" It’s all been spent on other

things. About $2.2 Trillion of Social Security and Medicare Surpluses - all

spent elsewhere by the US Treasury. Let’s see why this is. Many people are

upset because they think the government should have "saved the money"

for the future and often they are misled to believe this through the existence

of what are called the Social Security and Medicare Trusts, or sometimes known

as the Lock Boxes. In what form could the government save the money?

Perhaps:

* Keep it as US dollars

or deposit it in a bank,

* Invest in the private

sector, or

* Buy government bonds.

I.e. write IOUs to oneself.

Let's look at the first

possibility. If the government keeps the money as US dollars this is tantamount

to the Treasury intervening in monetary policy, which is the job of the Federal

Reserve. The Treasury would be essentially holding large sums of money out of

the economy for many years, which would not make sense at all. The Treasury

could instead decide to deposit the savings in a bank thereby making the funds

available for use in the economy and draw on its deposits later as benefits

fall due. But the banking system is backed up by the government itself, so the

promises of the bank to make good on depositor’s funds is ultimately the

promise of the government to itself. So why bother with all the banking fees?

It makes more sense for

the government just to write a note to itself - "I owe to myself $x

trillions of dollars", which is essentially what happens. A similar

argument applies to investing the funds in the non-government guaranteed

private sector. The private sector depends for its success on the stability and

financial security of the State. If the State collapses so does the private

enterprise defined by the rules of the State. If certain private enterprises

collapse it shouldn't affect the State, except if there is massive widespread

collapse like the recent banking crisis and then the State would step in to

provide as many guarantees as possible. So some ultimate risks are still born

by the State. The main point is that investing in the private sector carries

with it higher risks than holding a government obligation. And the main point

of Social Security is to pass risk from those that can least bear it over to

those that can. Private investing without government guarantees completely

removes this risk transfer feature of Social Security and places private sector

investment risks onto those who can least afford it.

Therefore, as

nonsensical as it sounds, so long as there is a surplus collection, the most

sensible thing to do is for the Social Security and Medicare funds to pass over

the excess funds they collect each year to the Treasury for it to spend back

into the economy. The Treasury then writes an IOU to the trust fund to pay back

the amount it just spent on something else. Basically the Government is writing

an IOU to itself. Then they put the IOU in a box, lock it up and call it a safe

"lock box" or trust fund. Whether intentional or not, what

effectively happened to the Social Security and Medicare surpluses generated by

the Reagan Era FICA tax increases and reductions in benefits, helped fund

Reagan's big military build-up of the eighties. With a Federal Income Tax Cut,

but an increase in FICA taxes, the tax burden was less progressive, and the

loss in tax revenues in the general Treasury account was somewhat offset by

Social Security Surpluses. This shifting of funds also enabled the government

to replace borrowing from the private sector (the markets), which it cannot

default on without dire consequences to the economy, with a promise to "pay

back" the funds to Social Security and Medicare many years in the future

when needed. This is a much less serious promise than issuing debt to the

private sector because future governments may very well get away with reducing

publicly funded social security benefits if they argue it effectively enough.

However the government

cannot default on debt issued to the private sector else it will send the

markets into a tailspin (since it is the most risk-free asset) and thus send

the world's economy crashing. The Bush tax cuts and the recent extension of

those cuts has compounded this trend of borrowing from Social Security and

Medicare to make up for lower general revenues and thereby fund other

government expenditures, and substitute borrowing from the markets with

borrowing from Social Security/Medicare. Only time will tell if this was the

right move or will promises be broken.